New credit risk report

We are pleased to announce that a new report entitled “Credit Risk Report” is now available in the Pictet Connect reporting module.

What is the purpose of this new report?

This report provides an overview of the commitments that you, or the clients you manage, have to the Bank. For each account, it shows:

- The total collateral value

- The total lending valueThe total amount of commitments to the Bank (credit risks)

- The ratio of the total commitments to the total collateral value as a percentage

- The ratio of the total commitments to the total lending value as a percentage

How do you produce this report?

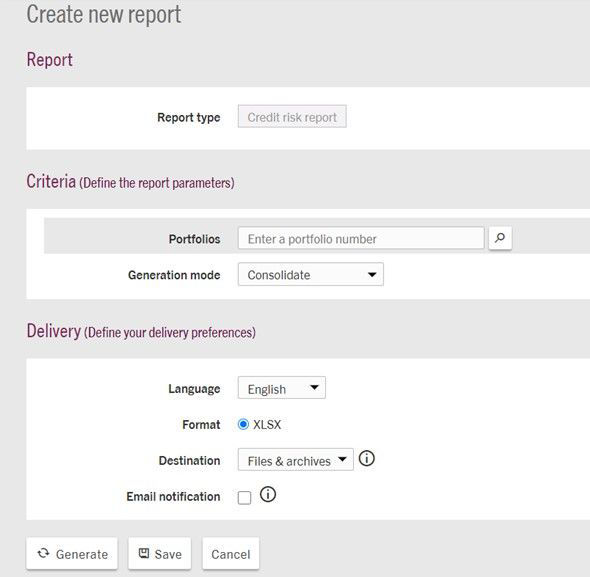

The report can be found in the “Portfolio Analysis” section of the reporting module. Simply select the accounts you wish to be included in the report, choose the language and format and then click on the “Generate” button.

Please note that access to the client’s account (Business Partner) in Pictet Connect is required for the report to work. Information on credit risks is not relevant at the level of individual portfolios (Container).

What are the current limitations?

For now, the report cannot be produced for accounts that are part of a group in which each account serves as collateral for the other accounts (“cross-pledge”). Furthermore, the information is based on the value of the portfolios as at the previous day’s close and not in real time. However, these two limitations will be fixed with the future developments described below.

What upcoming developments are expected in Pictet Connect?

The Credit Risk Report is only a first step in our efforts to give you more transparency over the commitments that you (or your clients) have to the Bank. We are planning to create a new page in Pictet Connect showing the lending values and commitments at the position level in real time.

What does the information in the report mean?

Client

The client (Business Partner) number, which groups together all the portfolios (containers) attached to this number.

Situation as at

Date on which the information was produced. The report looks for the last available date for each account, usually the last business day.

Currency

Client’s reference currency.

Total collateral value

The total value of the client’s portfolios, including the value of other portfolios serving as collateral, if any.

Total lending value

The sum of the lending values of the assets held in the client's portfolios, including the lending values of other portfolios serving as collateral, if any. The lending value of an asset is its market value, multiplied by a ratio that varies depending on the amount, quality, volatility and liquidity of the asset.

Total commitments

The sum of the risk values of the assets resulting in a credit risk, including commitments granted on other accounts. Examples of assets subject to credit risk:

- Current account overdrafts

- Fixed-term advances

- Sureties

- Guarantees

- Payment obligations and pledges granted to secure commitments of third parties, expressed in the form of an amount

- Short selling

- Commitments arising from forward transactions and the use of derivatives, expressed in the form of a credit risk equivalent

Total commitments vs total collateral value

The total commitments divided by the total collateral value. This ratio is given for information only. Any corrective measures are based on the ratio below.

Total commitments vs total lending value

The total commitments divided by the total lending value. This ratio must not exceed 100%. If it is higher than 100%, measures must be taken to rectify the situation.